【ZA Bank】Our 2024 full-year results are in! 🏆

ZA Bank, Hong Kong’s first and largest digital bank1, has recently announced its full-year results for 2024, successfully delivering strong financial performance thanks to its relentless focus on quality growth and operational efficiency. The bank recorded net revenue2 of HKD 548 million, while net loss narrowed significantly by 42% YoY, reinforcing the bank’s market-leading position.

Calvin Ng, CEO of ZA Bank, said, “Our ambition is clear: to surpass one million users by 2025 and establish ourselves as the preferred wealth management platform for Hongkongers. In 2024, we’ve already reached a significant milestone with over 800,000 users, representing more than 13% of the city’s bankable population. This is a strong validation of our all-in-one platform model and a clear sign of the market’s appetite for more innovative, accessible financial solutions. We remain committed to serving the needs of a new generation of Hongkongers—from young professionals and newly arrived talent, to those navigating key life transitions—by delivering tailored, goal-oriented financial services that support them at every stage of their journey.”

Highlights of 2024 annual results3

- Net revenue HKD 548 million

- Net interest income soared by 86% to HKD 489 million

- Net loss significantly narrowed by 42%, an HKD 167 million improvement from the previous year

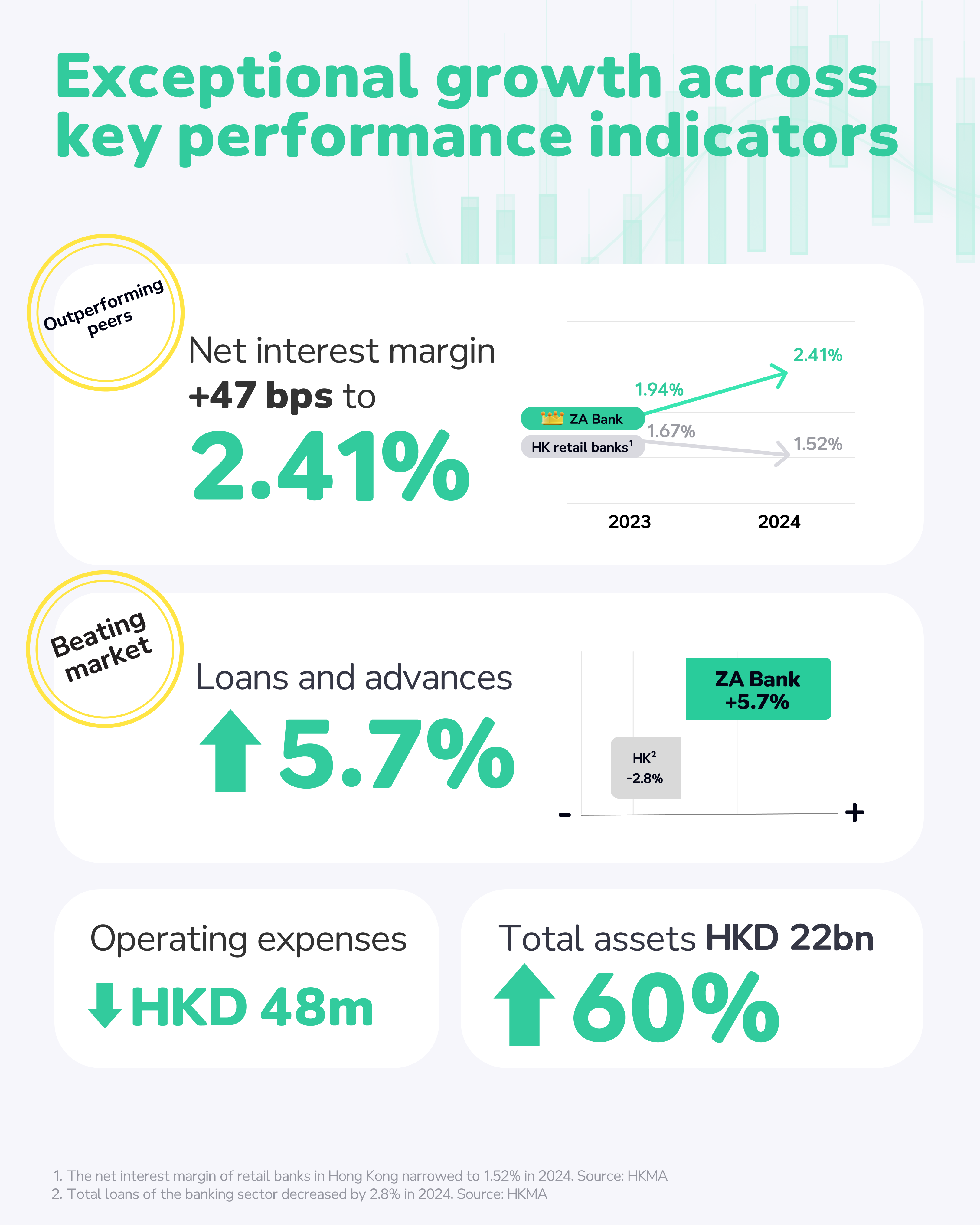

Exceptional growth across key performance indicators

- Net interest margin (NIM) expanded by 47 basis points to 2.41%, outperforming retail banks in Hong Kong4

- Loans and advances grew by 5.7% to HKD 5.6 billion, beating industry trends5

- Total assets increased by 60% to exceed HKD 22 billion

- Operating expenses were reduced by HKD 48 million

All-in-one platform to empower wealth growth

Strong growth momentum in wealth management business:

- Expanded investment product suite to meet diversified asset allocation needs

- Over 170 investment funds available in the ZA Bank App

- Rolled out US stock trading services in February, followed by the launch of StockBack, Hong Kong's first stock rebate programme

- Became Asia’s first6 licensed bank to offer crypto trading services to retail users in November

Innovative savings products driving deposit growth:

- High-Rate Pot and other products gained traction

- Customer deposits surged 66% to HKD19.4 billion

High user satisfaction for investment products7

Between 2024 and 2025 Q1, ZA Bank conducted a series of investment user surveys to gain insights into customer preferences and behaviours. The following analysis presents key findings derived from these survey results:

- US stock trading: Respondents found the ZA Bank App trading interface simple, easy to use, and with a smooth experience. The security of the trading platform was also an important factor in their choice, demonstrating their trust in ZA Bank.

- Fund investment: Low subscription fees, transparent information and easy operation were cited as the main advantages. In the survey, some investors with over 1 million AUM indicated that they only chose ZA Bank as their main fund investment platform for the above reasons, highlighting the attractiveness of the platform in the professional market.

- Crypto trading: The service is widely adopted by users as it enables direct transactions with savings account balance and eliminates the hassle of extra transfers. According to the survey, 75% of respondents affirmed the protection offered by banks in terms of fund security and fraud prevention measures, and felt more at ease when using virtual asset services.

The future of banking: Web3 and beyond

- Business customers doubled, providing best-on-class digital banking services to over 3,000+ companies

- Continued to promote the development of the Web3 ecosystem, serving over 200 Web3 companies including major virtual asset trading platforms (VATPs) in Hong Kong

- In an industry first, the bank became Hong Kong’s first digital bank to offer dedicated reserve banking services for stablecoin issuers.

- Became the first digital bank partner of Global Payments in Hong Kong to launch innovative SME financing solutions to support local businesses

Recognised worldwide, built on trust

Top-notch security8

- Adopted about 20 RegTech solutions—nearly half are developed in-house—including a real-time fraud detection solution and a back-end anti-fraud management system

- 24/7 risk management system upgraded to 4th generation

- 10 times better risk control performance since launch

Global recognition with multiple “only HK bank” wins

- Named among Asia’s top 15 digital banks in Fortune’s inaugural Fintech Innovators Asia 2024 list—the only Hong Kong company to be recognised in the “digital banking” category

- First Hong Kong bank to be named “Rising Star” in the prestigious “Awards for Excellence" by Euromoney. ZA Bank was the only Hong Kong bank to win in this category in 2024, and one of just four winners worldwide

- Consecutively awarded the “Virtual Bank of the Year - Retail Banking” title in the respected "Triple A Digital Awards" by The Asset

- Recognised with the “SME Digital Innovation of the Year - Hong Kong” award by Asian Banking & Finance for the Bank’s express online business account opening service

Here’s a brief infographic recap of the key figures for each key indicators to help you get a quick overview of ZA Bank's exceptional performance last year 🎉

.png)

For more details, check out the full 2024 Annual Report here.

Notes:

1. As the first digital bank to launch in Hong Kong, ZA Bank had the highest number of users and customer deposits among the city’s eight digital banks as of 30 June 2024. Source: Interim reports of 8 digital banks.

2. Net revenue is the sum of net interest income, handling charges and commissions, net gains/(losses) on other financial instruments and other income.

3. All figures are as of 31 December 2024 unless otherwise specified. Percentage denotes year-on-year growth rate.

4. The net interest margin of retail banks in Hong Kong narrowed to 1.52% in 2024. Source: HKMA

5. Total loans of the banking sector decreased by 2.8% in 2024. Source: HKMA

6. “Asia’s First” refers to licensed banks in Asia (excluding West Asia) that, as of 21 November 2024, have a comprehensive regulatory framework for virtual assets and are members of FATF. This designation specifically applies to licensed banks that provide services for retail investors to trade cryptocurrencies directly using fiat currency through their main applications.

7. Source: ZA Bank’s consolidated analysis of multiple user surveys and platform data between 2024 and Q1 2025.

8. Source: ZA Bank internal data.

Important risk statement

Investment involves risks. The price of investment products may fluctuate or even become worthless. Past performance is not an indicator of future performance. Losses may be incurred rather than making a profit as a result of investment. The information in this platform is for reference only and does not constitute and should not be regarded as any recommendation, offer or solicitation to purchase or sell any investment products. You should carefully and independently consider whether the investment products are suitable for you in light of your investment experience, objectives, financial position and risk profile. Independent professional advice should be obtained if necessary. Please read the relevant terms and conditions together with the offering document and risk disclosure statements of the investment product before making any investment decisions. The information in this platform has not been reviewed by SFC or any regulatory authority in Hong Kong. ZA Bank is acting as your agent to handle the transaction. The investment product is provided by a third-party but not ZA Bank. In respect of eligible dispute (as defined in the terms of reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) out of the selling process or processing of the related transaction, ZA Bank will enter a Financial Dispute Resolution Scheme process with you. However, any disputes over the contractual terms of the product should be resolved directly between you and the third-party product issuer. The platform is not intended for distribution or use by any person in any jurisdiction, country or region where the distribution or use of this material is restricted and would not be permitted by law or regulation, If you are outside of Hong Kong, we may not be authorised to offer or provide you with the products and services available in the country or region where you are located or resident.

Crypto Disclaimer

Investment involves risks. Virtual asset is a new asset class and developed on the basis of new technology, involving unanticipated risks associated with acquisition, storage, transfer and use. Prices of virtual assets could be highly volatile and investors are reminded to pay extra caution when deciding to invest in virtual assets. The price of virtual assets may fluctuate or even become worthless. Past performance is not an indicator of future performance. Losses may be incurred rather than making a profit as a result of investment. The information in this platform is for reference only and does not constitute and should not be regarded as any recommendation, offer or solicitation to purchase or sell any investment products. You should carefully and independently consider whether the investment products are suitable for you in light of your investment experience, objectives, financial position and risk profile. Independent professional advice should be obtained if necessary. Please read the relevant terms and conditions together with risk disclosure statements before making any investment decisions. In respect of eligible dispute (as defined in the terms of reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) out of the selling process or processing of the related transaction, ZA Bank will enter a Financial Dispute Resolution Scheme process with you. The platform is not intended for distribution or use by any person in any jurisdiction, country or region where the distribution or use of this material is restricted and would not be permitted by law or regulation. If you are outside of Hong Kong, we may not be authorised to offer or provide you with the products and services available in the country or region where you are located or resident.