【ZA Bank】ZA Bank achieved first-ever interim net profit of approximately HKD 49 million 🎊

(6).png)

ZA Bank, Hong Kong’s first digital bank, today announced its interim results for 2025, achieving outstanding results driven by steady growth in core business and improved operational efficiency. The bank recorded its first-ever interim net profit of HKD 49 million in the first half of 2025, and also became the first digital bank in Hong Kong to surpass 1 million users, solidifying its leading position in the local digital banking market.

Calvin Ng, CEO of ZA Bank, said, “As Hong Kong’s first digital bank, ZA Bank has reached a significant milestone - recording our first-ever half-year profit and surpassing one million users within just five years. This achievement demonstrates that even in a mature financial market like Hong Kong, seizing the right opportunities can still lead to meaningful breakthroughs. It also echoes the latest Global Financial Centres Index, where Hong Kong ranks first in APAC, and has climbed to the top globally in fintech, a clear sign of the market’s growing embrace of innovative financial models. AI and digital assets are redefining the rules of banking, from operations to risk to relationships. At ZA Bank, we are building faster, smarter, and more dependable digital wealth experiences, powering what’s next in digital finance.”

Highlights of 2025 interim results1

Outstanding results achievement 💯

- Achieved first-ever interim net profit of approximately HKD 49 million

- Reached 1 million users milestone

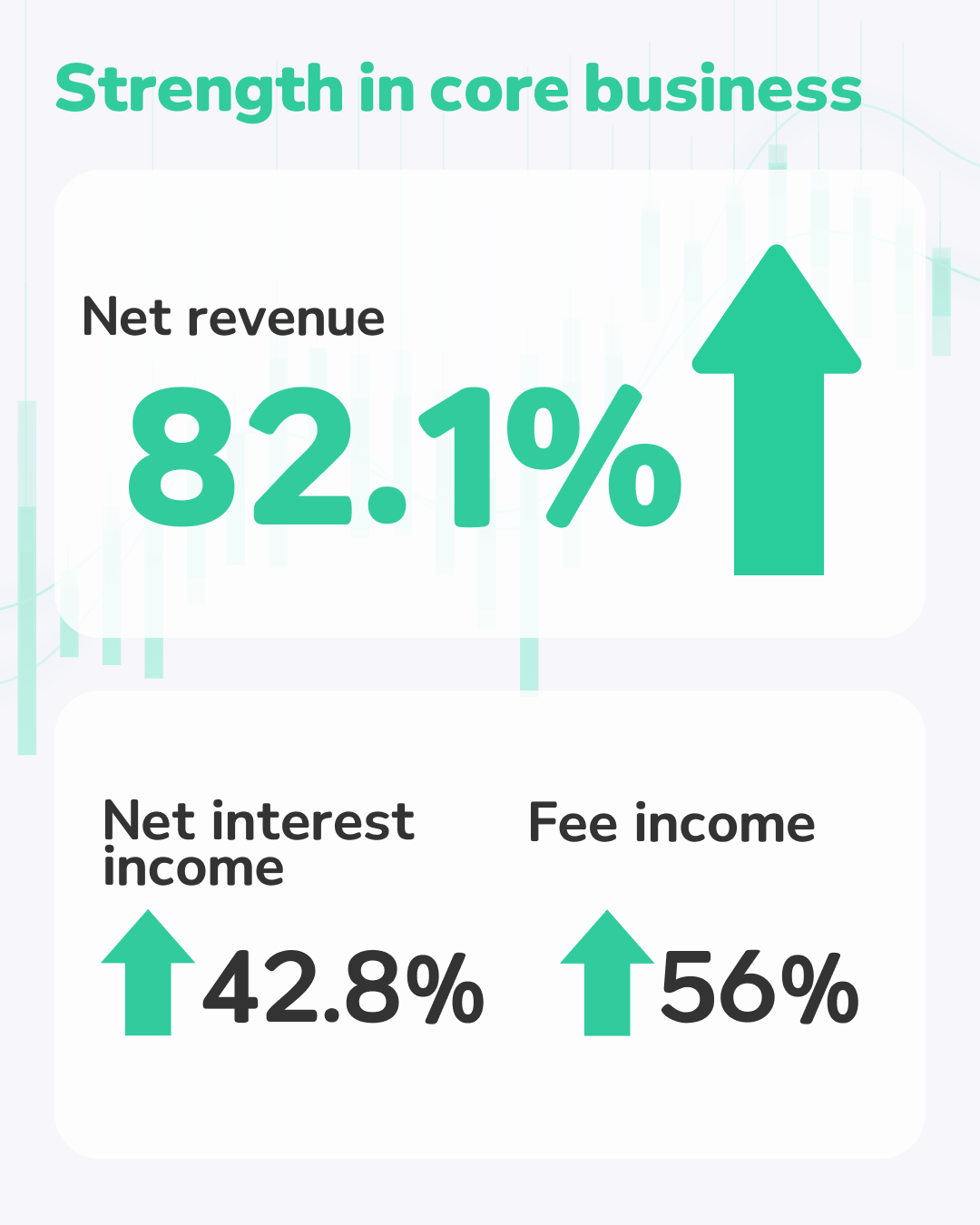

Strength in core business 💪

- Net revenue increasing by 82.1% year-on-year

- 42.8% rise in net interest income

- 56% growth in fee income

Solid growth in asset size 📈

- Customer deposits expanded to over HKD 21.1 billion

- Net interest margin remained solid at 2.38%

- Bank’s total assets reached HKD 24.65 billion

Wealth management fuels growth 💰

- Assets under management (AUM) from Invest users increasing by over 125% year-on-year

- One-stop investment platform: Seamlessly integrates traditional and digital assets

1. Funds

2. US Stocks

3. Crypto

Advancing digital asset development 🤖

- Banking partner of majority of licensed VATPs in HK

- Provided banking services to over 300 Web3 companies

- 1st HK digital bank to offer dedicated reserve asset custody service to stablecoins sandbox participants

- Looking ahead: ZA Bank will deepen institutions’ collaborations, broaden digital assets use cases and actively support HK’s development as a global hub for digital asset innovation

Award winning innovation💡

- Global recognition: Honoured with “Best Digital Bank” and “Best Retail Crypto Services” at the International Finance Awards

- Industry recognition: The Asset Triple A Digital Awards’ “NextGen Digital Bank of the Year” this year

- Excel in user experience: With an innovative, simple and functional design that combines outstanding user experience with robust security, we were awarded the 2025 iF Design Award from Germany

Cutting-edge technology for risk management 🔍

Proprietary real-time transaction monitoring system, XDecision:

- Processes over 600,000 risk assessments daily

- With 90% completed within 0.2 seconds

AI powered operations:

- Applying AI to fraud detection & risk alerts

- Proprietary anti-fraud engine & Dual-cloud architecture for enhanced protection

To view the full 2025 Interim Report, please visit: bank.za.group/agreement/pdf/en_US/1002249

1. Data as of 30 June 2025 unless otherwise stated. Percentage denotes year-on-year growth rate.