Instant transfers, zero fees! Your guide to using FPS

According to the latest statistics from the Hong Kong Interbank Clearing Limited, the number of new registrations for Faster Payment System (FPS) has set a new record, with a total of 16.216 million accounts registered by the end of February this year1. As Hong Kong's No.1 Digital Bank2, ZA Bank has always been committed to providing users with convenient financial services. Through this article, ZA Bank will help you quickly understand this efficient and secure payment method—FPS, allowing you to enjoy a better and more convenient payment experience.

Part 1: What is FPS?

FPS is an instant payment system launched by the Hong Kong Monetary Authority in 2018. It lets users make quick and secure interbank transfers using a mobile number, email address, FPS ID or QR code. Whether paying bills, transferring to friends, or conducting transactions with merchants, FPS offers great convenience. ZA Bank also supports FPS, allowing users to enjoy convenient and secure transfer services.

Advantages of FPS

- Convenient: Requires a payee's mobile number, email address or FPS ID only

- Cross bank/e-Wallet: Full connectivity among local banks and e-wallets

- Instant transfer: Almost real-time fund settlement

- Anytime, anywhere: 24 x 7 round-the-clock operation

- Multiple currencies: Supports HKD and RMB

Part 2: How to use FPS?

- How do I register for FPS?

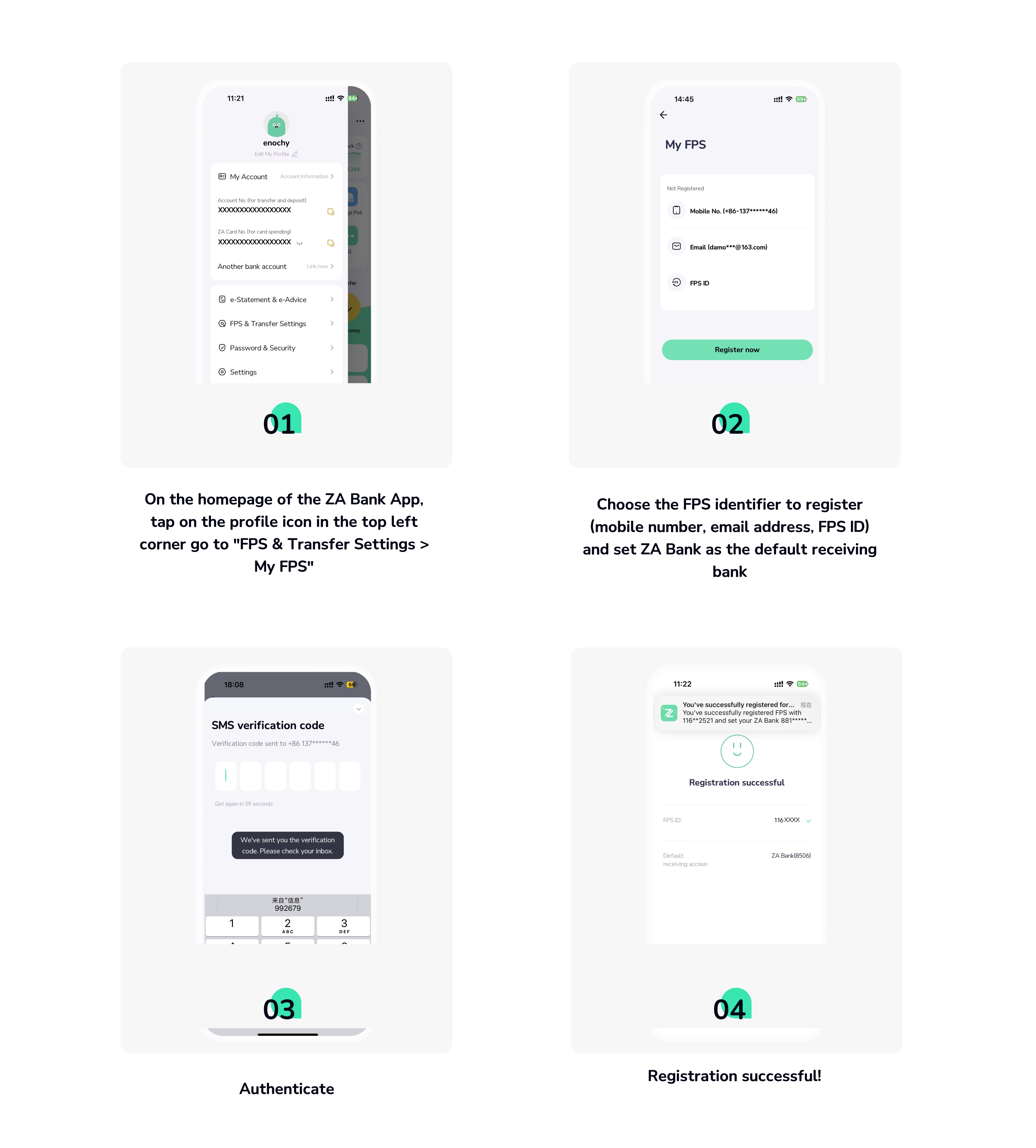

If you haven’t registered for FPS, you can register in the ZA Bank App first. The registration process is very easy. Just follow the instructions below, and you can complete it in a few easy steps. Once you have registered, you can use FPS to make transfers.

Steps 👇

- How can I transfer using FPS?

Making payments and receiving funds using FPS is very simple. Simply enter the payee's FPS information or scan the QR code to complete the transfer. The payee will receive the funds within seconds, providing an efficient and convenient experience.

To learn about the specific operation of transfer, you can refer to previous articles:

https://blog.za.group/article/Transfer_Guidance

Part 3: Common Questions about Using FPS

Q1: What should I do if I haven't received the money after the transfer?

A1: If the payee has not received the funds after the transfer, please first check if the payee's information entered is correct via Activity or e-Advice. You can further ask the payee to check if his FPS receiving bank is indeed the bank account he intends to use to receive the funds. If all the above information is correct, we recommend contacting ZA Bank customer service, and we will assist you in resolving the issue.

Q2: What are the fees for FPS?

As of date, ZA Bank does not charge any fees for transfers made by retail customers using FPS. You can use it with confidence and enjoy a zero-cost payment experience.

Q3: Is there a mobile app for FPS?

FPS is not a standalone mobile app but is integrated into the banking system. To use FPS, you only need to download the ZA Bank App.

If you encounter any issues while using it, you can also contact 24 x 7 online customer service via ZA Bank App anytime!

1. For details, please refer to the statistics published by the Hong Kong Interbank Clearing Limited on 'FPS'.

2. As Hong Kong's first digital bank, as of 30 June 2024, ZA Bank has the highest number of users and deposits among the 8 digital banks in Hong Kong. Source: Mid-term performance reports of the 8 digital banks.