【ZA Bank】Credit Card Payment | Why Choose FPS to Settle Cross-Bank Credit Card Payments? Here are Four Reasons Why

【Credit Card Payment】After using your credit card for purchases, remember to keep track of the repayment due date and pay on time to avoid paying interest and penalty fees for late payments! If you have multiple credit cards from different banks, you can use the credit card repayment function in the ZA Bank App to manage your payments conveniently and quickly across different banks with just one app.

In addition to the ability to manage cross-bank payments, the ZA Bank App's credit card repayment function also has 4 other thoughtful features that help you handle your credit card payments!

Credit Card Payment Method | Manage Payments Across Different Banks with Faster Payment System (FPS)

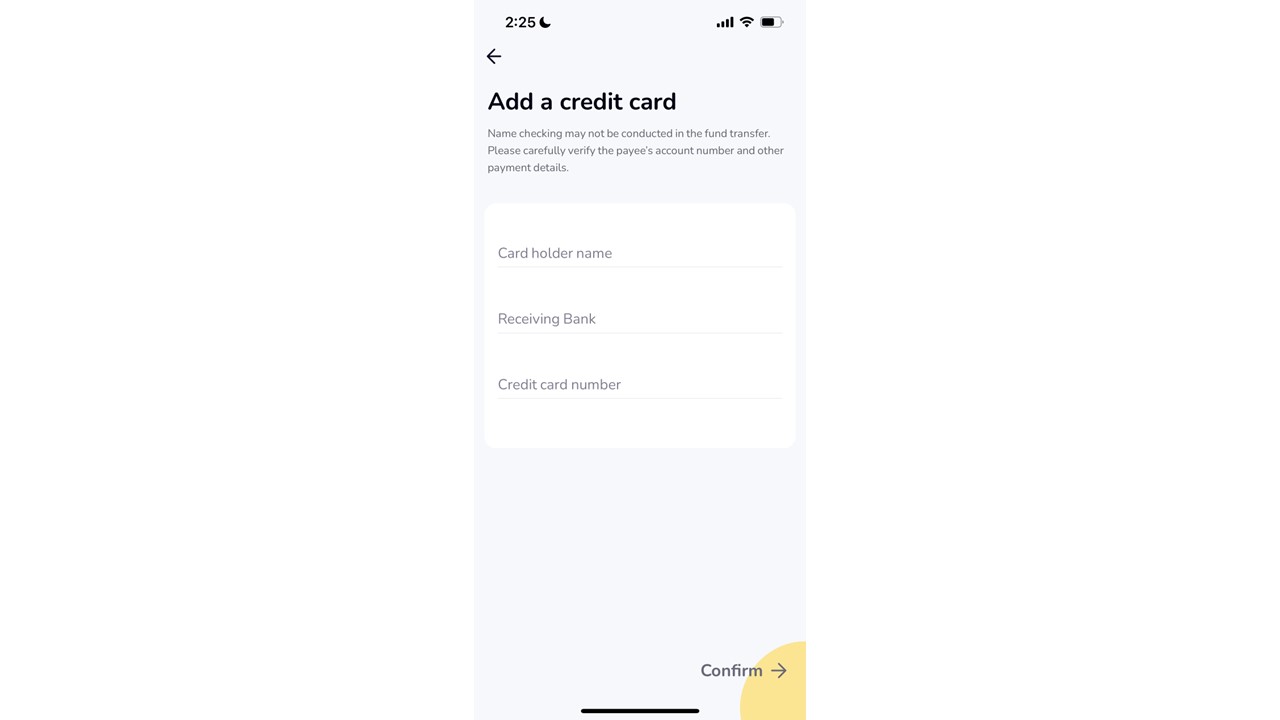

The introduction of Faster Payment System (FPS) in 2018 has simplified the process of settling credit card payments across different banks in Hong Kong. With ZA Bank App, users can enjoy the hassle-free service by registering with only the cardholder’s name, receiving bank, and credit card number.

Apart from allowing users to settle credit card payments with ease, ZA Bank App’s credit card repayment function also boasts 4 main features:

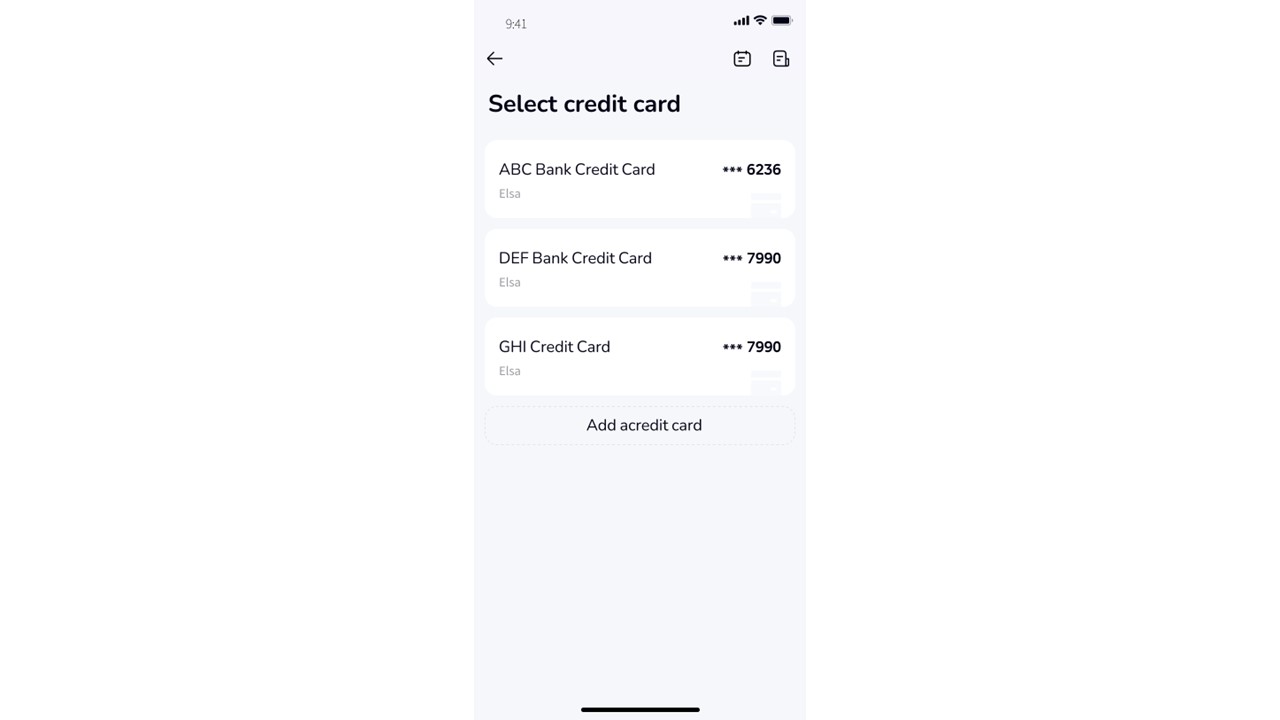

1️⃣ Settle Payments of Multiple Credit Cards, Across Different Banks!

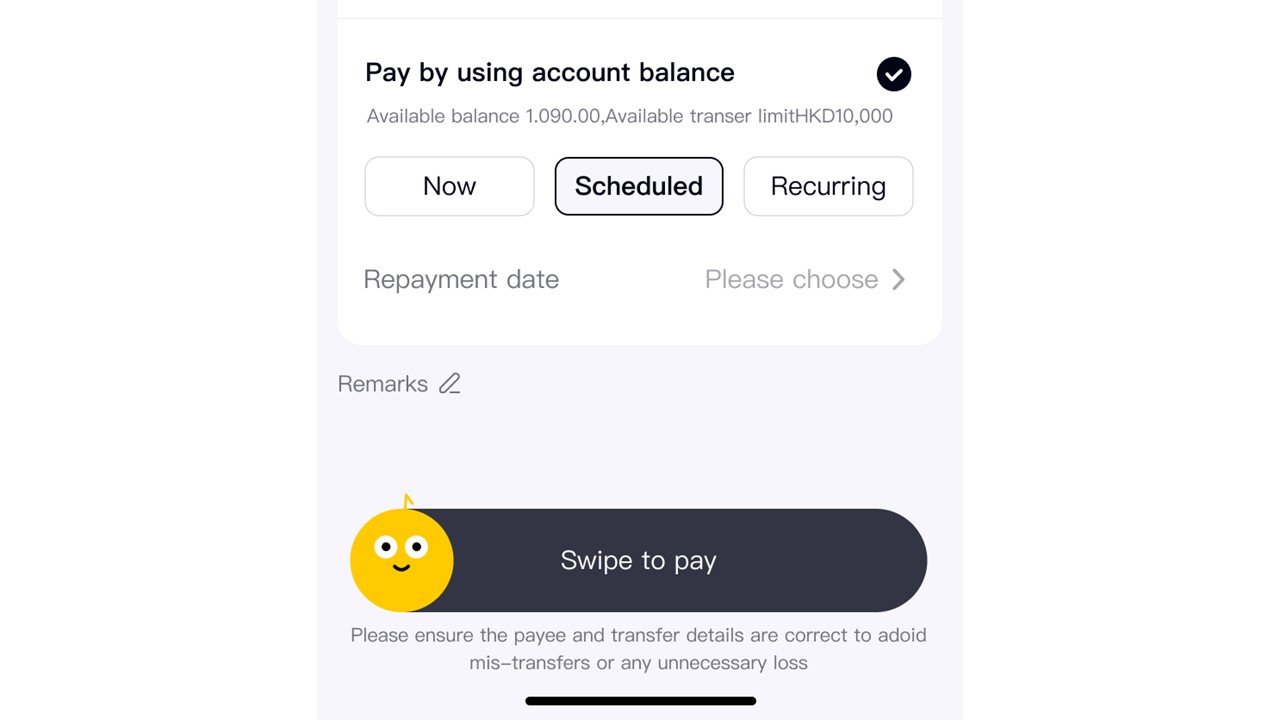

2️⃣ Schedule Transfer Dates, Say Goodbye to Late Fees!

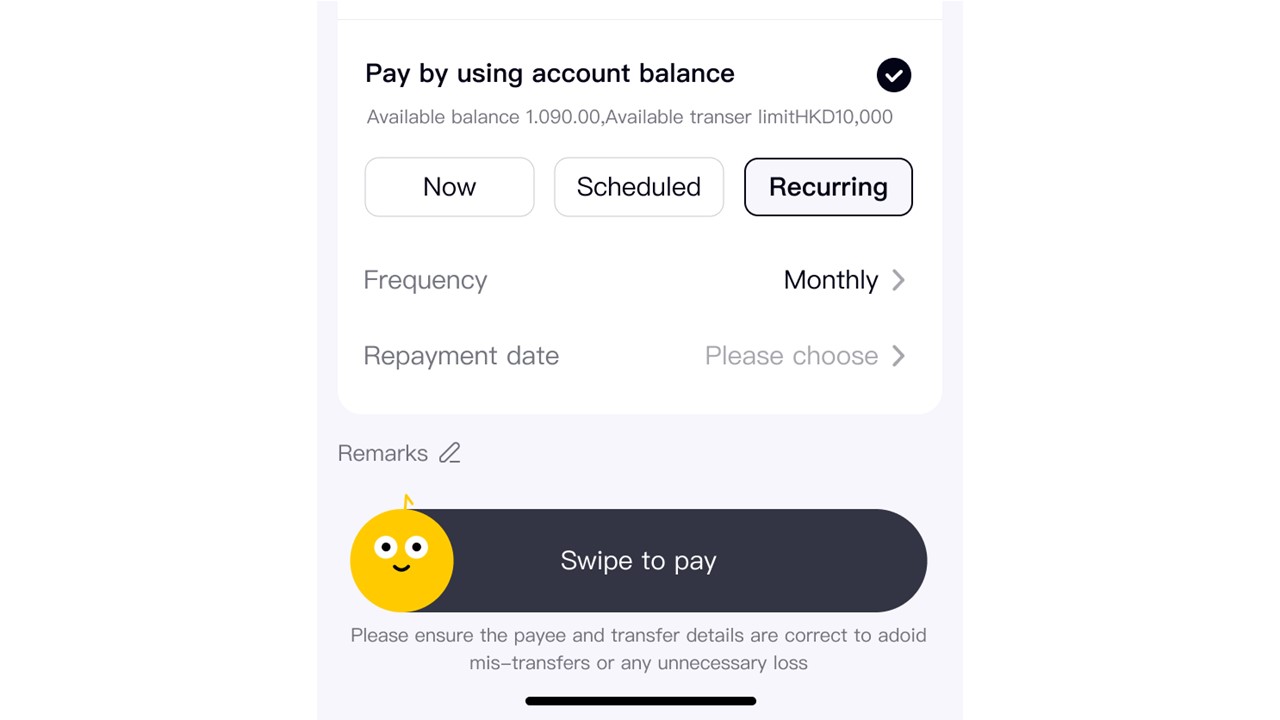

3️⃣ Set up Regular Payments, Saving You Time and Effort!

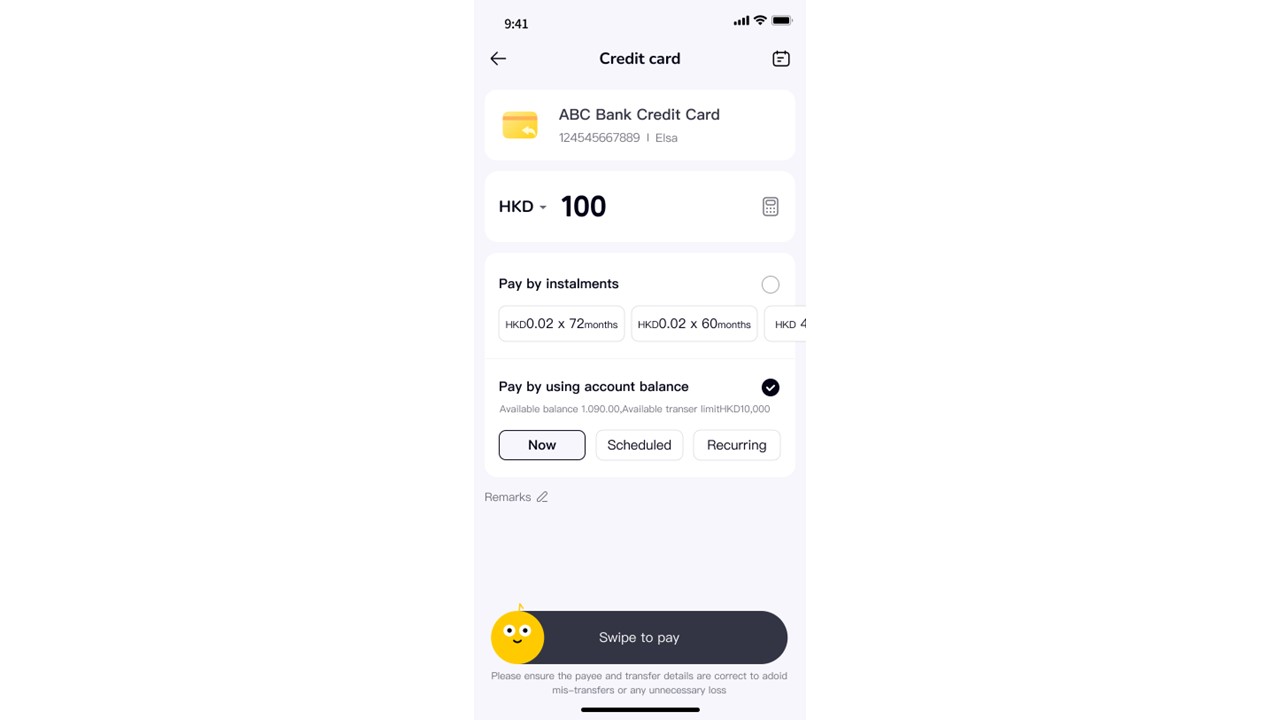

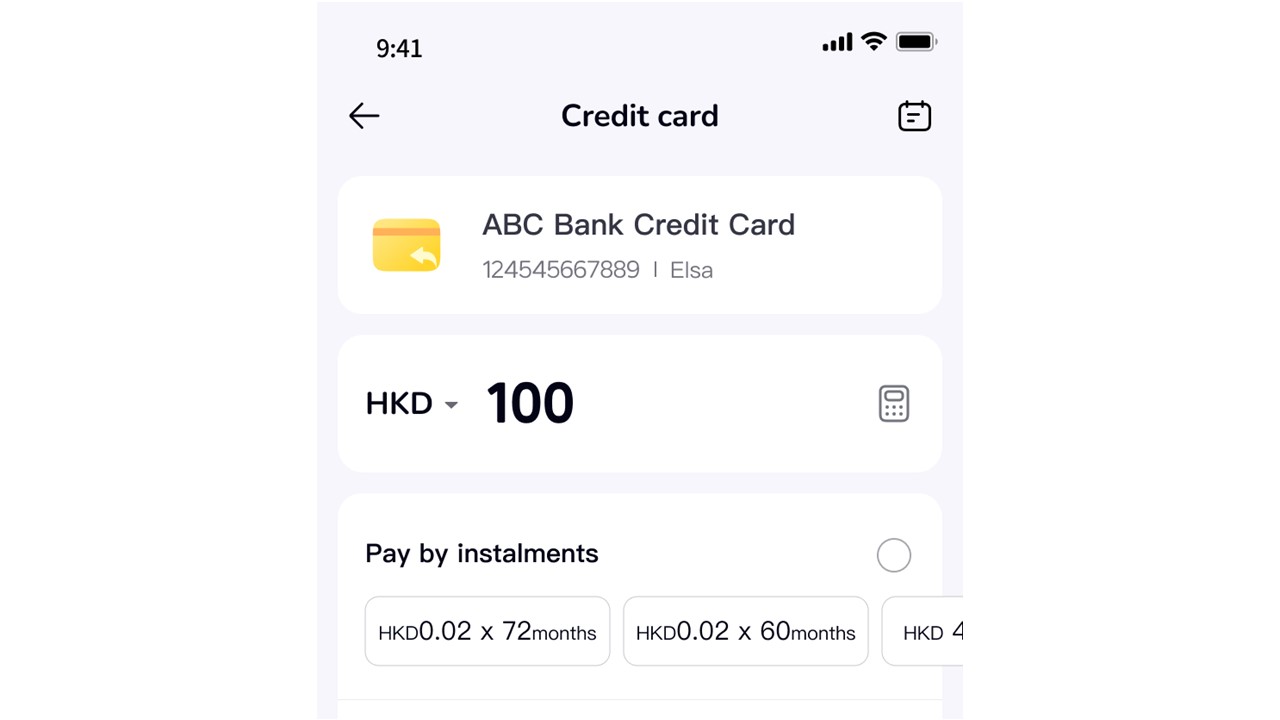

4️⃣ Apply for Installment Payment Periods of up to 72 Months, with Great Flexibility! To Borrow or Not to Borrow? Borrow Only If You Can Repay!

Credit Card Payment Method | ZA Bank App’s Credit Card Repayment Function

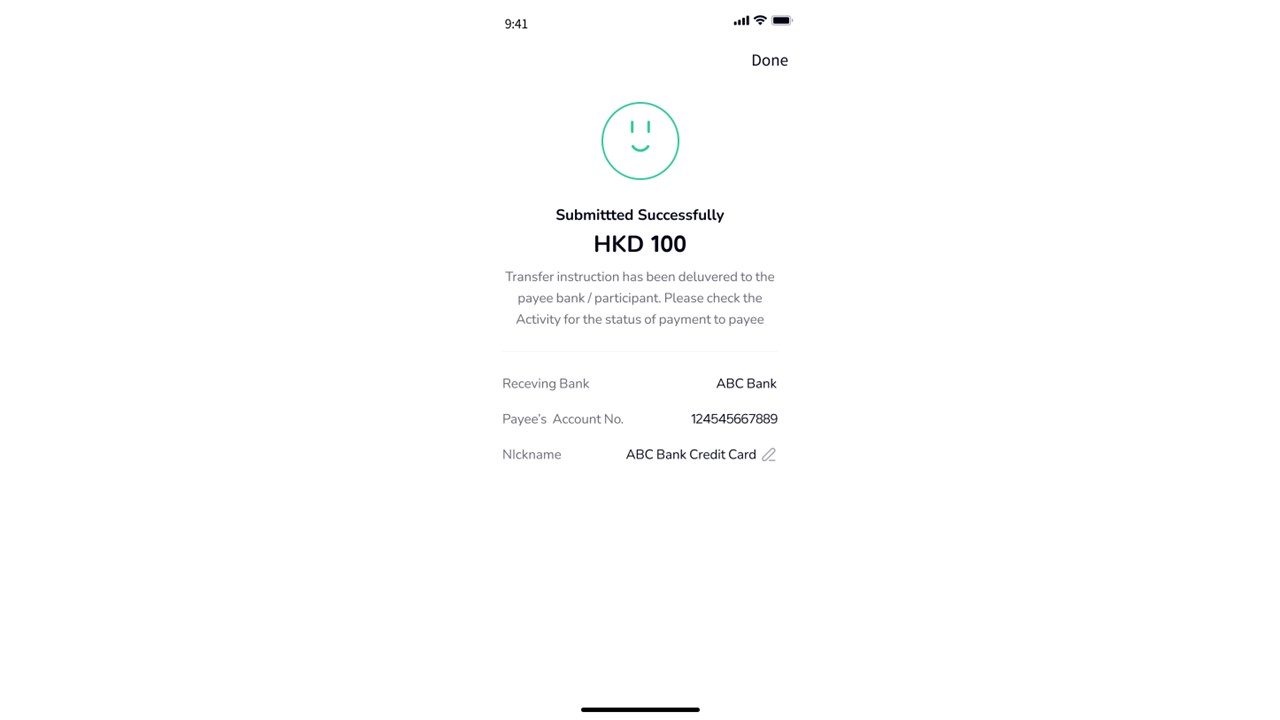

In just three simple steps, you can use ZA Bank App's credit card payment function settle your payments with ease!

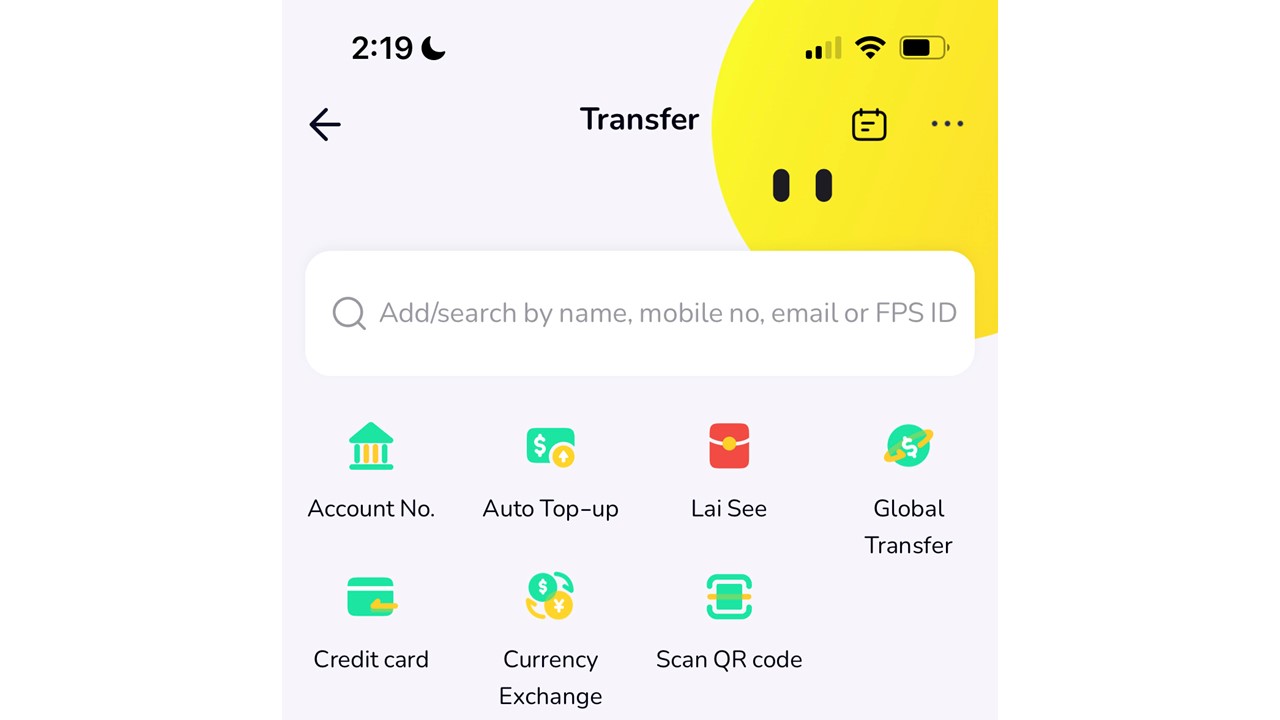

💡 Step 1: On the “Transfer” page, click on “Credit Card”

💡 Step 2: Fill in your credit card number and related banking information

💡 Step 3: Input the amount and settle the payment with your balance in a swipe!

😎 Quick tip: ZA Bank App's FPS cross-bank credit card repayment function supports 18 local banks in Hong Kong, so you can manage payments for most major banks' credit cards!

In addition to simplifying the credit card repayment process, the function also offers the following thoughtful features:

Save multiple credit cards from different banks, and you won’t have to enter the details again for future payments!

Set a scheduled transfer date for credit card payments, and ZA Bank App will automatically settle the payment on the specified date, providing greater financial flexibility!

Set up recurring credit card payments with a frequency and payment date of your choice, never miss a payment anymore!

Want to pay installments? ZA Bank App has got it covered too!

• Apply with just one click and receive initial approval in 30 seconds 1

• Upload relevant documents (if required)

• Confirm your application and the funds will be disbursed to your credit card account immediately!

Get Started with ZA Bank’s Credit Card Payment Function Today!

All ZA Bank users can now use the credit card repayment function on the ZA Bank App, making it hassle-free to manage payments across different banks!

If you are not already a ZA Bank user, sign up now and enjoy a brand-new banking experience as Hong Kong’s No.1 Virtual Bank2!

1 This approval result is preliminary. Users are required to submit proof documents before receiving the final result. The actual completion time varies across individuals. In general, provided that all required information is in order, an existing bank user can get the preliminary approval result in as fast as 30 seconds from starting an application in “Loan” tab after logging into ZA Bank App. The final approved loan amount, interest rate and tenor may vary depending on the individual circumstances and the final assessment of the bank.

2 “No. 1 Virtual Bank” refers to ZA Bank’s leading position derived from the total number of users, deposits, assets and income as of 31 December 2022 among the eight licensed virtual banks that provides digital banking services (Source: Annual reports of eight virtual banks).