【ZA Bank】How our in-house security tech protects your money🛡️

The recent rise in online scams has heightened concerns over the security of online finances among consumers, who are even becoming sceptical of e-banking. In fact, banks in Hong Kong are considerably capable in terms of risk management and IT security. ZA Bank is one of the local banks that has developed its own proprietary systems to safeguard its users’ money.

Over the past 4 years since our launch, we have been introducing and optimising various fintech tools. Our Regtech, risk control and IT security systems are now at their 3rd generation 🚀. We have incorporated around 20 digital solutions, nearly half of which were developed in-house, including the real-time fraud detection solution “X Decision” and a back-end anti-fraud management system. All systems operate 24x7 to protect our users’ assets.

🎯Enhanced risk control and anti-fraud capabilities

Based on internal data1, we have delivered nearly 4x better performance in real-time transaction monitoring and anti-fraud decision-making compared to our early days:

- · The number of transactions screened in real time has reached 100,000 per day🔍

- · Our system can analyse and process around 10 transactions per second on average👨🏻💻

- · Anti-fraud decision-making can be done in as fast as 40 milliseconds⏱️

Between July 2022 and June 2023 alone, we have successfully used network analytics to detect suspicious financial activities involving about HKD 4 billion².

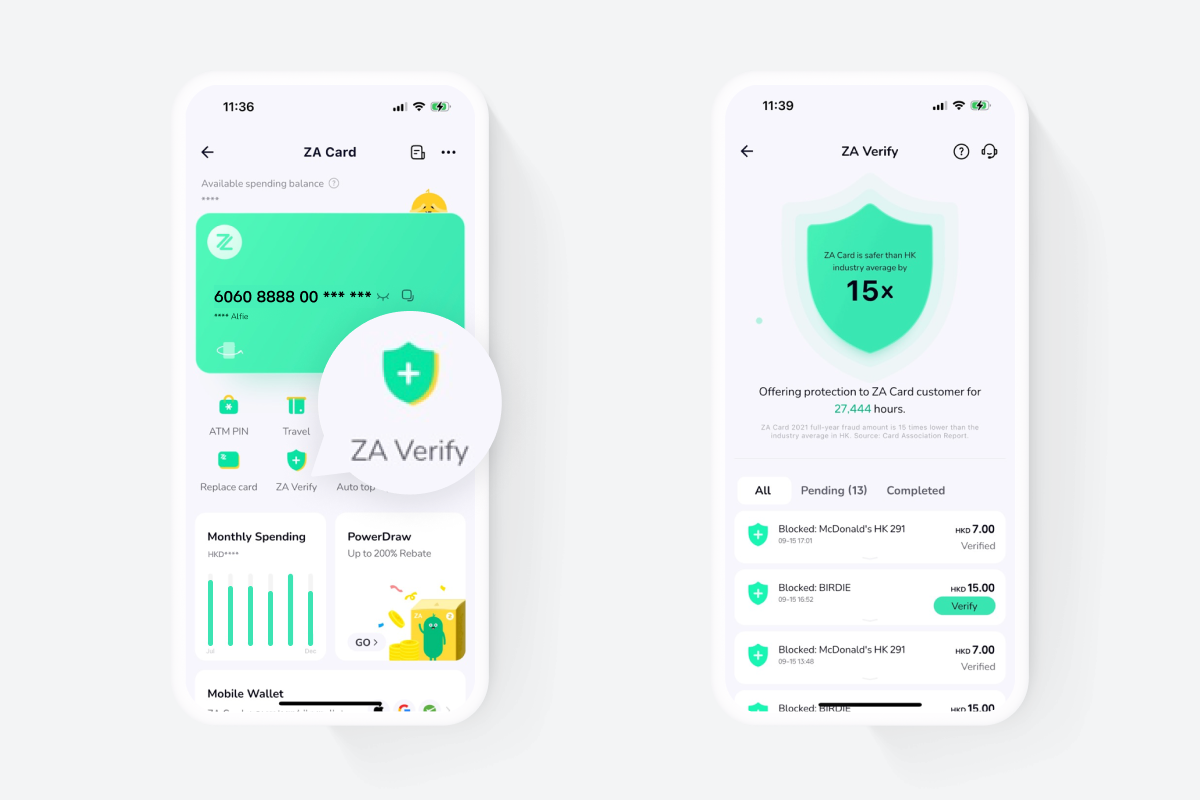

We also have a security feature designed specifically for ZA Card: “ZA Verify” 🛡️. A risk control scoring model for card transactions was developed in-house by analysing users’ card transactions and behavioural data. The system scores each transaction and rejects high-risk transactions, while medium-risk transactions will trigger ZA Verify. Users will be asked to confirm or reject a ZA Card transaction via the ZA Bank App whenever the system identifies a risk, making card spending a safer experience. According to a Card Association report, the full-year fraud amount of ZA Card in 2021 was 15 times lower than the industry average in Hong Kong ✅.

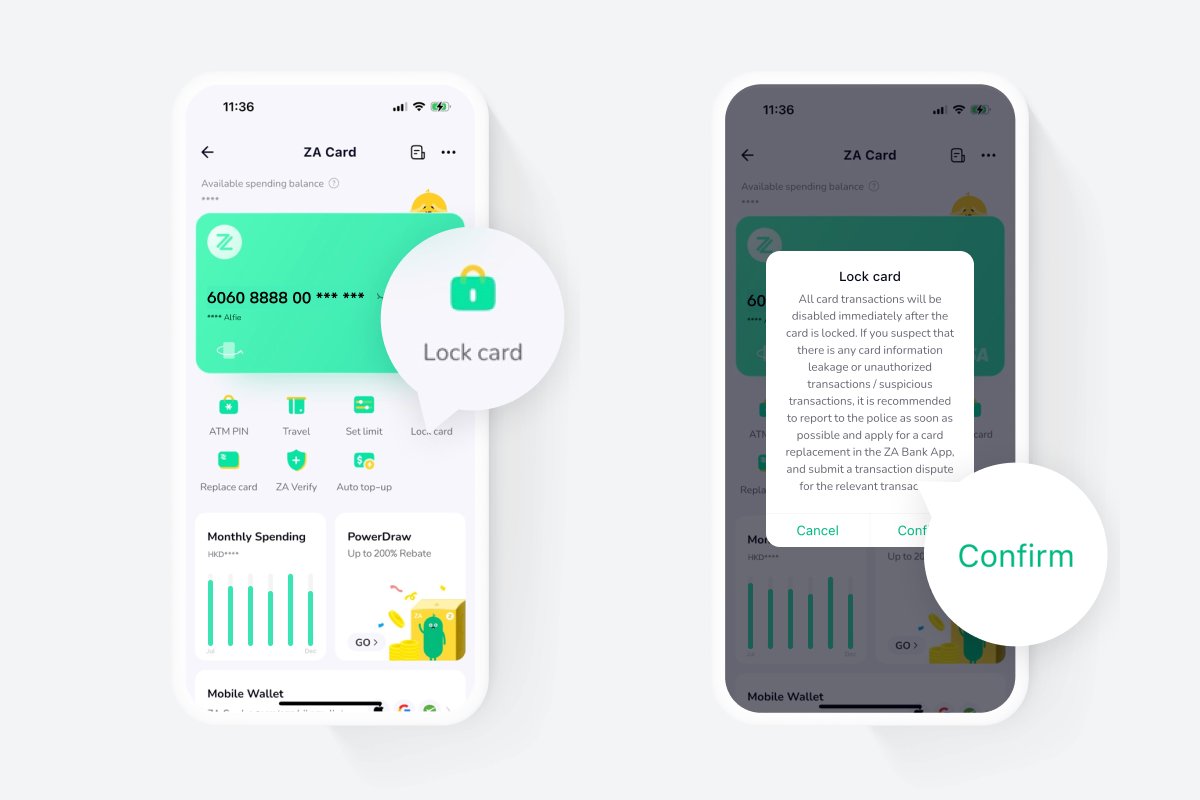

If users have lost their ZA Card or suspect that card information has been leaked, they can lock their card in the ZA Bank App anytime.

🏆Growing trust in society with multiple security-related awards

Our tireless efforts and achievements have earned third-party recognition. We recently received the annual “Good Organisation Award” presented by the Hong Kong Police Force at the “Good Citizen Award Presentation Ceremony 2023”. ZA Bank was the only bank to be awarded in this category this year and the first local digital bank to receive the award. We have also bagged the “Effective Regtech Application Award” at another ceremony hosted by the Police. These are a testament to our outstanding performance in safeguarding users' assets and preventing risks associated with money laundering and fraud with our proprietary systems.

💪Building a stable, reliable financial ecosystem through tech-driven innovation

As a new company, we leverage technology to drive innovation and integrate finance and technology. We continue to enhance our technologies and develop products to boost consumers’ trust and support for digital or online banking, thereby facilitating the development of a thriving industry. We will continue to create a more reliable and secure financial ecosystem for the public.

ZA Bank was the only bank to receive the “Good Organisation Award” this year, and it was the first local digital bank to be awarded in this category.

ZA Bank received the “Effective Regtech Application Award” at this year’s Bank Staff Recognition Ceremony.

Remarks:

1. Data as of February 2024.

2. Source: ZA Bank's internal data.