IPO makes money in market corrections

The Hong Kong stock market experienced obvious corrections on 26 July and 27 July, with the Hang Seng Index dropped more than 980 and 1,100 points respectively to a low of 25,086 on 27 July. This 2-day drop marks a correction of about 8%. Referring to the attached chart, it demonstrated the index from August 2011 to July 2021. While this 2-day drop was significant, the 3-month index decline as of end of July is already about 10%. Looking at the index over the past decade, there had been quite a number of major market corrections.

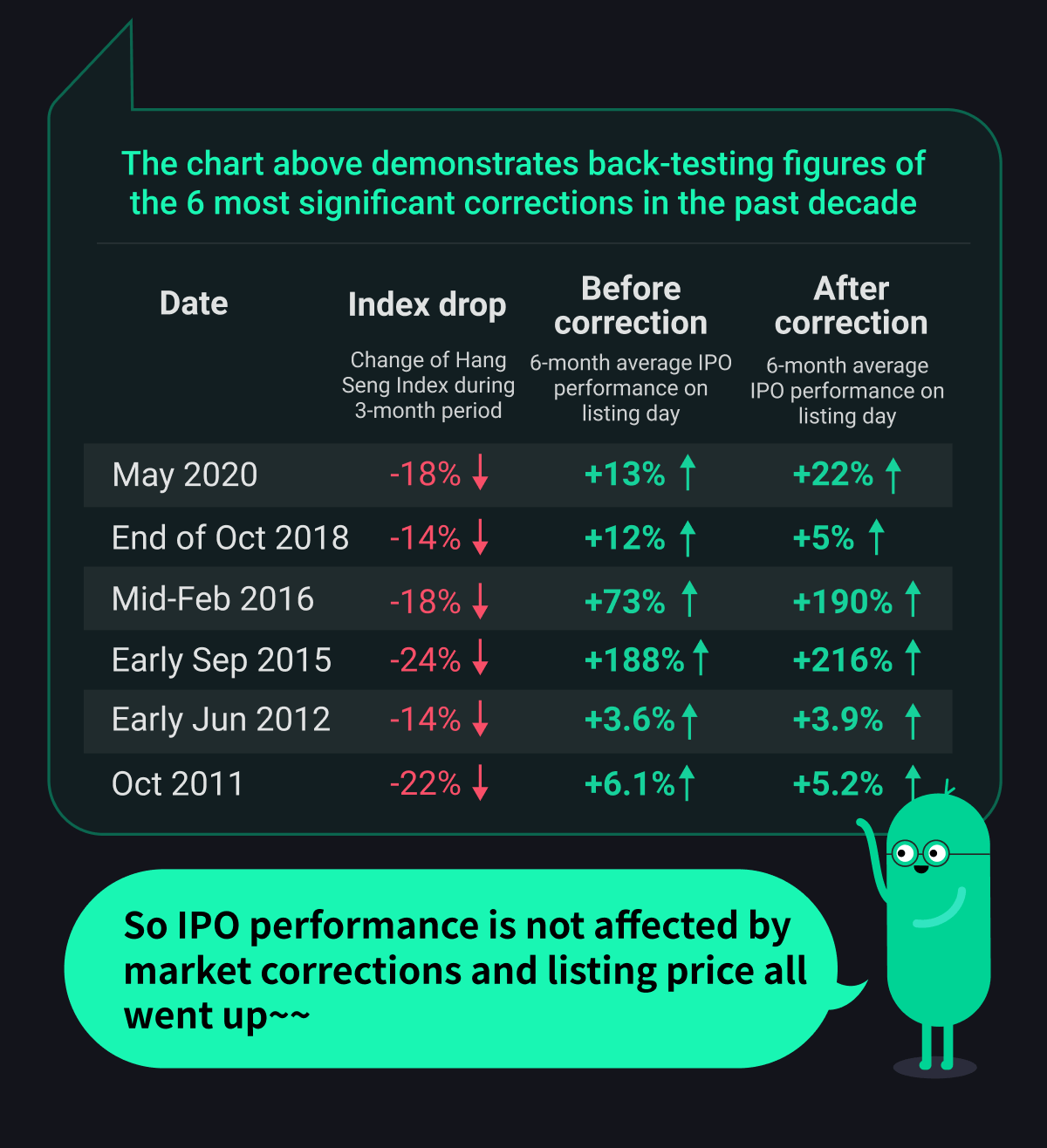

We tally the 3-month index point change for each trading days over the past decade and marked the 6 most significant index drops which occurred in May 2020 (down 18%), end of October 2018 (down 14%), mid-February 2016 (down 18%), early September 2015 (down 24%), early June 2012 (down 14%) and October 2011 (down 22%). Looking at the index chart, it seemed the market managed to rally back to previous high. With the recent correction in end of July, the valuations of the stock market can be more attractive to long-term investors.

In order to observe if market corrections have any impact to IPO stock performance, we have compared the price changes on first listing day of IPOs before and after major market corrections. We obtain the price changes on the first listing day of 1,238 IPOs since July 2011, and then we calculate the 6-month average of these price changes before and after a market correction. Here are our observations:

May 2020 (6-month average of first day price change before correction: +13%; 6-month average of first day price change after correction: +22%);

End of October 2018 (6-month average of first day price change before correction: +12%; 6-month average of first day price change after correction: +5%);

Mid-February 2016 (6-month average of first day price change before correction: +73%; 6-month average of first day price change after correction: +190%);

Early September 2015 (6-month average of first day price change before correction: +188%; 6-month average of first day price change after correction: +216%);

Early June 2012 (6-month average of first day price change before correction: +3.6%; 6-month average of first day price change after correction: +3.9%); and

October 2011 (6-month average of first day price change before correction: +6.1%; 6-month average of first day price change after correction: +5.2%).

Except for the corrections in year 2011 and 2012, when the average price changes were similar before and after a correction. The average price after a correction were better than the same before a correction three out of four times after year 2012. Therefore for IPO stocks investors, there could be more potential after the recent market correction in end of July 2021.

1) The above information is provided by AA Investment Management Limited. ^The 6 most significant index drops of the 3-month index point change for each trading days over the past decade, as of 31 Jul 2021.

2) IPOGo, investment services and discretionary client account services are provided by AA Investment Management Limited (‘AA Invest’). AA Invest is regulated and licensed by the Securities and Futures Commission of Hong Kong (SFC CE No.: BQF712) with Type 1, 4 and 9 regulated activities. AA Invest is the business partner of ZA International Financial Services Limited (‘ZAIF’) and offers the above regulated activities via ZA One.

3) ZA One is an App developed and operated by ZAIF. ZA One and ZAIF are not provider of IPOGo. The content of IPOGo in ZA One and ZAIF are for reference only and is not any personalised investment recommendation, does not constitute any offer, invitation or recommendation to any person to enter into any transaction described therein or any similar transaction. ZA One and ZAIF will not make any representation, make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness and shall not be held liable for damages arising out of any person's reliance upon this information.

4) There is a risk that the company's share price will drop below its initial IPO price; IPOGo client may suffer loss, please consider before participating in IPOGo service.

5) The promotional offer is provided by AA Invest. Please refer to relevant terms and conditions, including (a) New Customer Promotion Code Offer; (b) Lifetime Management Fee Waiver Promotion and (c) Member Get Member Programme. The reward of New Customer Promotion Code Offer and Member Get Member Programme are in a form of ZA Coin (a third-party reward scheme operated by ZAIF). Terms and Conditions of ZA Coin apply for redemption. For details, please visit coin.za.group. AAIM is not obliged to notify you of any changes or latest announcements of ZAIF.

6) The information is for reference only and does not constitute any offer, invitation or recommendation to any person to enter into any transaction described therein. Investment involves risks. The price of investment products may fluctuate or even become worthless. Past performance is not an indicator of future performance. Losses may be incurred rather than making a profit as a result of investment. You should carefully and independently consider whether the investment products are suitable for you in light of your investment experience, objectives, financial position and risk profile. Independent professional advice should be obtained if necessary. Please read the relevant terms and conditions together with the risk disclosure statements in the prospectus of the investment product before making any investment decisions. The content has not been reviewed by SFC or any regulatory authority in Hong Kong.