Insurance 101 - The ‘Gap’ You Might Not Know in Your Protection

❗️ Have you ever wondered how much insurance you need? According to ‘Mortality Protection Gap Study 2021’1 recently published by Hong Kong Insurance Authority (HKIA), Hong Kong is the 11th largest life insurance market in the globe with total premiums worth HKD 511 billion in 2019. However, the mortality protection gap (MPG) is reaching a threatening level of HKD 6.9 trillion – each working adult is averagely bearing HKD 1.9 million protection gap, which is 5.7 times of their annual income.

🤔 What is ‘Mortality Protection Gap’?

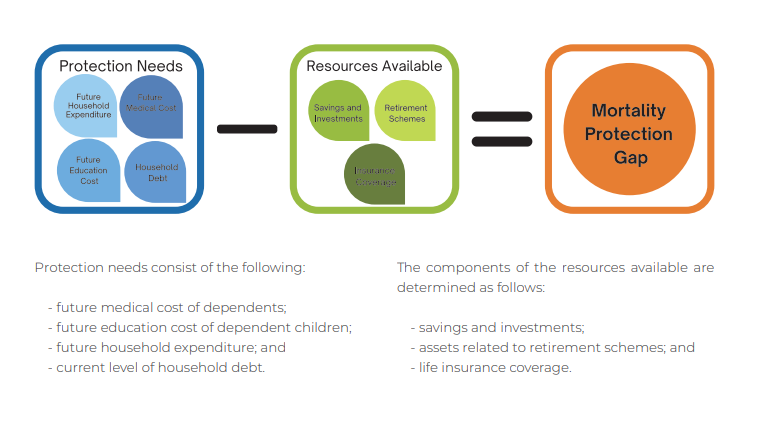

MPG is a number to quantify how dependents will be impacted after the death of the family’s most important economically active adult. It is defined as ‘Protection Needs’, consisting of future medical cost of dependents, future education cost of dependent children, future household expenditures and current level of household debt, minuses ‘Resources Available’, consisting of savings and investments, asset related to retirement schemes and life insurance coverage. In other words, the larger the MPG, the bigger the burden left to the family.

💣 Why does ‘Mortality Protection Gap’ become a problem In Hong Kong?

Hong Kong’s insurance density and penetration ranked the highest in the world for life business in 20202. Over half of the life insurance premium of Hongkongers is spent on individual whole life protection which in certain level, serves the purpose of wealth accumulation and investment. Although insured person can take back a guaranteed amount of money after certain period, the savings and investment elements reduce the ability of the life insurance policy to hedge mortality risk. So generally speaking, its mortality protection is less than the term life insurance.

⛑ How to close ‘Mortality Protection Gap’?

We suggest everyone should review your protection once in a while because the MPG changes with different life stages, such as marriage, childbirth and property purchase. There are term life insurance products in the market which are designed to provide pure protection in certain period of time. Without elements of savings and investments, they have a better death benefit than the whole life insurance does. You can upgrade your protection plan with the extra term life insurance according to your needs.

Now at ZA Bank, you can purchase ‘ZA Life Protection’ that is good value for your money3. We offer up to HKD 10 million term life insurance. In terms of cost-performance ratio4, you’ll be insured with more than HKD 3,125 life protection for every HKD 1 premium. No medical exams are required, and the premium will not be affected by the family’s medical history. From now till 31 Oct, you can enjoy a 20% off on the first year premium5 of you ‘ZA Life Protection’ by simply entering the promo code,‘SEP21’ during the purchase on ZA Bank App.

Notes:

1 Source: Mortality Protection Gap Study

2 Ibid. The calculation of the insurance density and penetration quoted by Swiss Re includes insurance premiums contributed by the MCVs

3 “Good value for your money” refers to the best cost performance ratio in Hong Kong on 5-year and 10-year of ZA Life Protection for applicants aged between 28 and 65 with the comparison to term life insurance products in the market, which is based on a market survey conducted on 21 April 2021. Pure life protection refers to term life insurance with no savings component.

4 Cost Performance Ratio = Sum Insured / Annual Premium

5 The promotion period valid until 31 October 2021. For details, please refer to terms and conditions. Customer can enjoy a 20% off discount on the first-year premium by using the designated promotion code “SEP21” for any successful purchase of ZA Life Protection offered by ZA Life through ZA Bank App within the Promotion Period, without limitation on the number of usage. Please refer to the Product Brochure for detailed product features and provisions. Insurance products are underwritten by ZA Life Limited (with business name as ‘ZA Insure’) which is authorised and regulated by the Insurance Authority of the Hong Kong SAR. ZA Bank Limited (with business name as ‘ZA Bank’) is a licensed insurance agency (license number GA1009) authorised by ZA Insure.